Medigap or Medicare Supplement plans are the same things. They are additional plans available to you if you have Original Medicare Part A and Part B. You must be enrolled in both parts to be eligible for a Medicare Supplement or Medigap Plan.

Why would you consider a Medigap or Medicare Supplement Plan? Part A and Part B are great coverages just by themselves, however, there are some “Gaps” in coverage that you would be responsible for. Specifically:

-

Part A covers most of the hospital inpatient expenses. There is an initial deductible of $1,484 you are responsible for each benefit period. (A Benefit period begins the day you’ve been admitted and ends when you’ve been out of the hospital for 60 days)

-

Part A has copays for hospital stays. No Copay for the first 60 days, Copay is $371 per day for days 61-90, Copay is $742 per day for days 91+

-

Part A will cover skilled nursing facilities, No Copay for the first 20 days, Copay is $185 per day for days 21-100

-

Part B Coverage costs most individuals $148.50 per month and can rise as high as $504.90 depending on adjusted gross income.

-

Part B Deductible is $203 per year

-

Part B Co-pay is 20% of approved amounts with no annual out-of-pocket maximum.

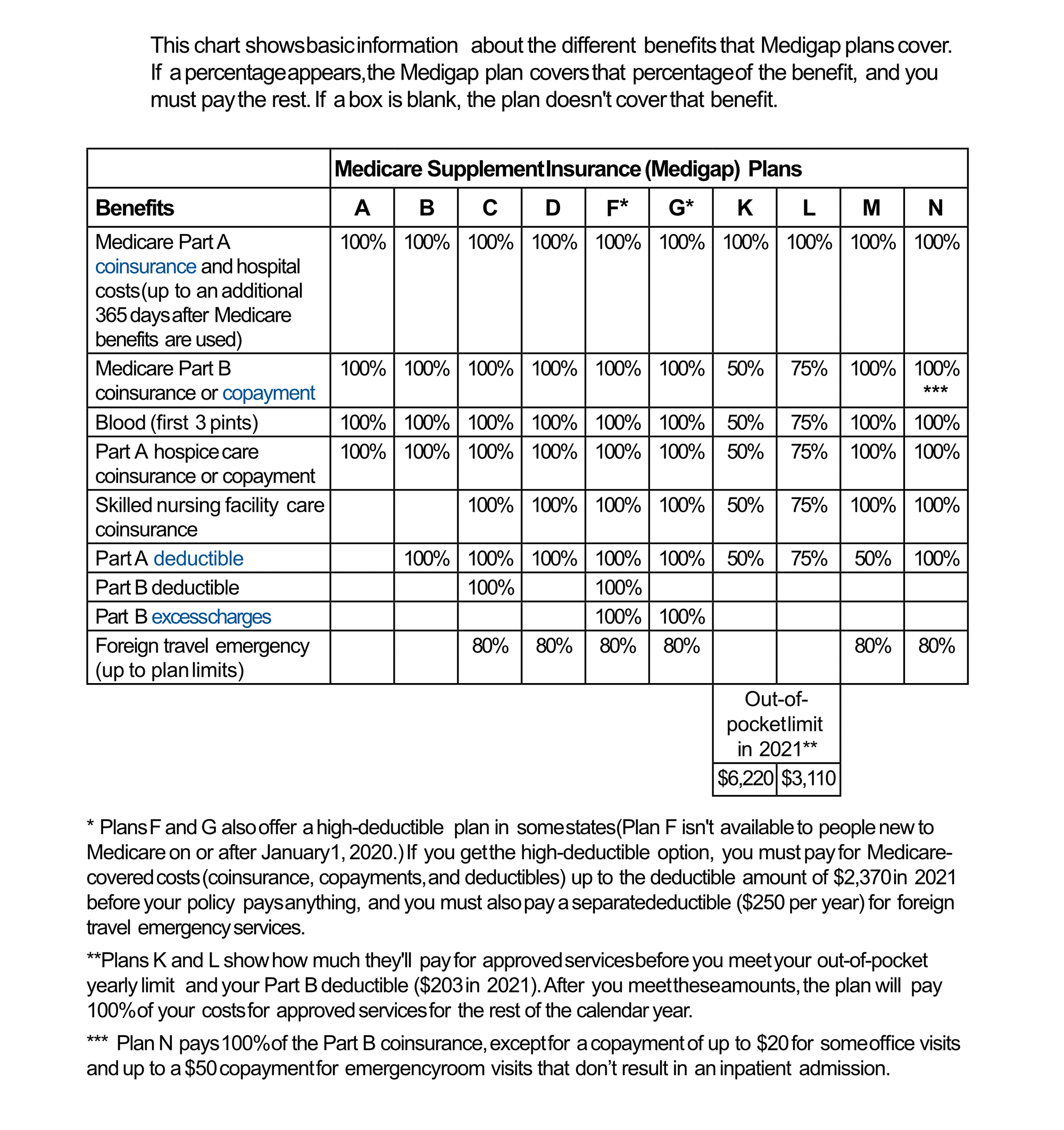

Medigap Plans are lettered A through N and they cover different amounts or Gaps in Medicare coverages as outlined above. It is easy to compare Medicare Supplement Plans side by side using the chart provided below. Each of the plans is regulated by CMS (Centers for Medicare and Medicaid Services) and each company must offer the same plan, Ex. Any of the plans are exactly the same plan for Company A as well as Company B.

This chart shows basic information about the different benefits that Medigap plans cover. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you must pay the rest. If a box is blank, the plan doesn’t cover that benefit.

One note to add in comparing plans, if you will note that Plan C and Plan F cover the Part B Deductible. Those plans are not available to anyone who was not eligible for coverage after January 2020. The most popular plan now is Plan G it covers everything except Part B Deductible and 80% of Foreign Travel emergency.

Access to Doctors

The main benefit that Medigap plans have over Medicare Advantage Plans is there is no network restriction regarding the doctors you visit. If the physician or physician group accepts Medicare payments, there are no restrictions. As long as they accept Medicare, they will accept your Medicare Supplement or Medigap plan.

Yes, Medigap or Medicare Supplement Plans have their benefits, with that being said, they are not for everyone. First, you must consider the cost of a Medicare Supplement Plan. They can range in price greatly between insurance providers. The premium must be paid monthly and most likely not go down in price, it can however increase over time.

Medigap plans do not include other services such as Dental, Hearing and Vision Plans. The main benefit to consider with a Medigap plan is the freedom to use any doctor or physicians’ group that accepts Medicare payments.

At Answers About Medicare we can help you weigh the pro’s and con’s of whether a Medigap plan is correct for you or another plan would better fit your needs.