I am sure by now you have gotten the famous booklet from CMS—Centers for Medicare and Medicaid Services, 2021 Guide to Choosing a Medigap Policy. Wow, it can be very confusing. Let’s take it one step at a time.

Start with Step One

In discussing Medicare, there are some very easy to understand basic parts and everything is based on them. There are 4 “Parts” not “Plans” with Medicare. They are Part A, (Inpatient Costs), Part B (Outpatient and Physician Costs), Part C, (Medicare Advantage) and finally Part D, (Prescription Drug Cards). That’s it, these are the parts of Medicare.

One area we did not mention, Medicare Supplement Plans or also known as Medigap Plans, this is not a part of the Medicare System, they are insurance contracts written through private insurance companies. The plans associated with a Medicare Supplement or Medigap Plan are known as “Plans” A, B, C*, D, F*, G, K, L, M, and N

*As of January 1, 2020, Medigap plans sold to people new to Medicare are not allowed to have the Part B deductible covered in an insurance plan. Therefore, Plan C and Plan F are no longer available to those new to Medicare.

Each of the Medicare Supplement or Medigap plans are mandated by the Federal Government to be the exact same coverage. The only difference between the plans, the government does not regulate the monthly premiums or costs. It is the licensed and trained representative to help you choose a plan morally and ethically within your budget and needs.

Plans E, H, I and J are no longer sold, but if you already have one, you probably will be able to keep it in force. Your Licensed Advisor can review those coverages with you and help you decide if there is any better coverage for you.

Who is eligible for Medicare Benefits?

If you are turning 65 or older and are an American Citizen or here legally with a “Green Card” and have been in America for at least 5 years, you are eligible to apply for benefits. If you have been diagnosed with a disability, receiving Social Security benefits for at least 2 years or 24 months, you can apply for benefits in the 25th month of disability.

If you meet the qualifications for Medicare, it is time to discover which program is right for your needs. There are quite a few options to choose from, let’s look at which one fits you.

Original Medicare—also known as Part A and Part B. These 2 parts are the only parts that you enroll with Social Security Administration. Part A is known as inpatient or hospital care. If you have worked for the past 10 years or 40 quarters, the government provides this coverage at no cost to you. Part B—is known as outpatient or physician services. This part is not free, currently most individuals get this coverage deducted out of their Social Security or Railroad Retirement Board monthly benefits. In 2021, the cost is $148.50 per month.

IMPORTANT: In order to apply for either a Medicare Advantage Plan or Medicare Supplement or Medigap Plan, you must be enrolled in Original Medicare, Part A and Part B.

Medicare Advantage Plans—Part C Coverage

The next plan to consider is Part C or Medicare Advantage Plans. Medicare Advantage Plans are contracted with private insurance companies through CMS (Centers for Medicare and Medicaid Services) which is part of the Department of Health and Human Services. These plans have some major benefits that Original Medicare does not offer. Most Advantage Plans include at no additional premium Part D or Prescription Drug Services.

Original Medicare (Part A and Part B), there are some co-pays or deductibles that need to be met. Original Medicare (Part A and Part B) do not have an out-of-pocket maximum and can be quite expensive. Part C or Medicare Advantage Plans are required to meet or exceed Original Medicare Coverage and they are required to set an annual out-of-pocket maximum. This means it will offer financial protection with out-of-pocket costs.

Medicare Advantage plans can vary from insurance company to insurance company, but in general offer many more services than Original Medicare. Most Medicare Advantage Plans offer Prescription drug cards (Part D) and a wide variety of other services such as Dental Coverage, Vision Benefits and Hearing Services included in the plan. Some plans offer transport service as well as Meal Benefits.

Medicare Advantage Plans Are Often Premium Free

There is a saying that nothing in life is ever free. Many plans are zero out of pocket premium, however have some restrictions with coverage. You might not pay premium monthly, however, there are some rules to follow.

Many plans are coordinated care plans within a network of physicians, clinics, and other healthcare providers. The 2 most common plans are referred to as PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization). This means that if you have a Medicare Advantage HMO Plan, you must choose a primary care physician that is a part of the plans network. If you have a PPO, there is a network plan, but you can use physicians not in the network at a higher price. Typically, this is not an issue, there are a wide variety of physicians to choose from and chances are your current physician is in the network.

In both PPO and HMO plans, you can go outside of the network, however you might end up paying more for services. This does not apply in emergency situations, if you need emergency services, all facilities will accept you.

Medicare Supplement also called Medigap Plans

Medicare Supplement also known as Medigap plans pay AFTER Medicare. The Medigap or Medicare Supplement plan will then cover the remaining 20% of approved charges.

It is very important to note all Medicare Supplement or Medigap plans are the same. They are mandated by the Federal Government to offer the same coverage regardless of the insurance company that is chosen. The only difference is the service and premium paid to have the plan.

Medicare Supplement or Medigap plans do not offer Prescription Drug benefits or dental, vision or hearing benefits.

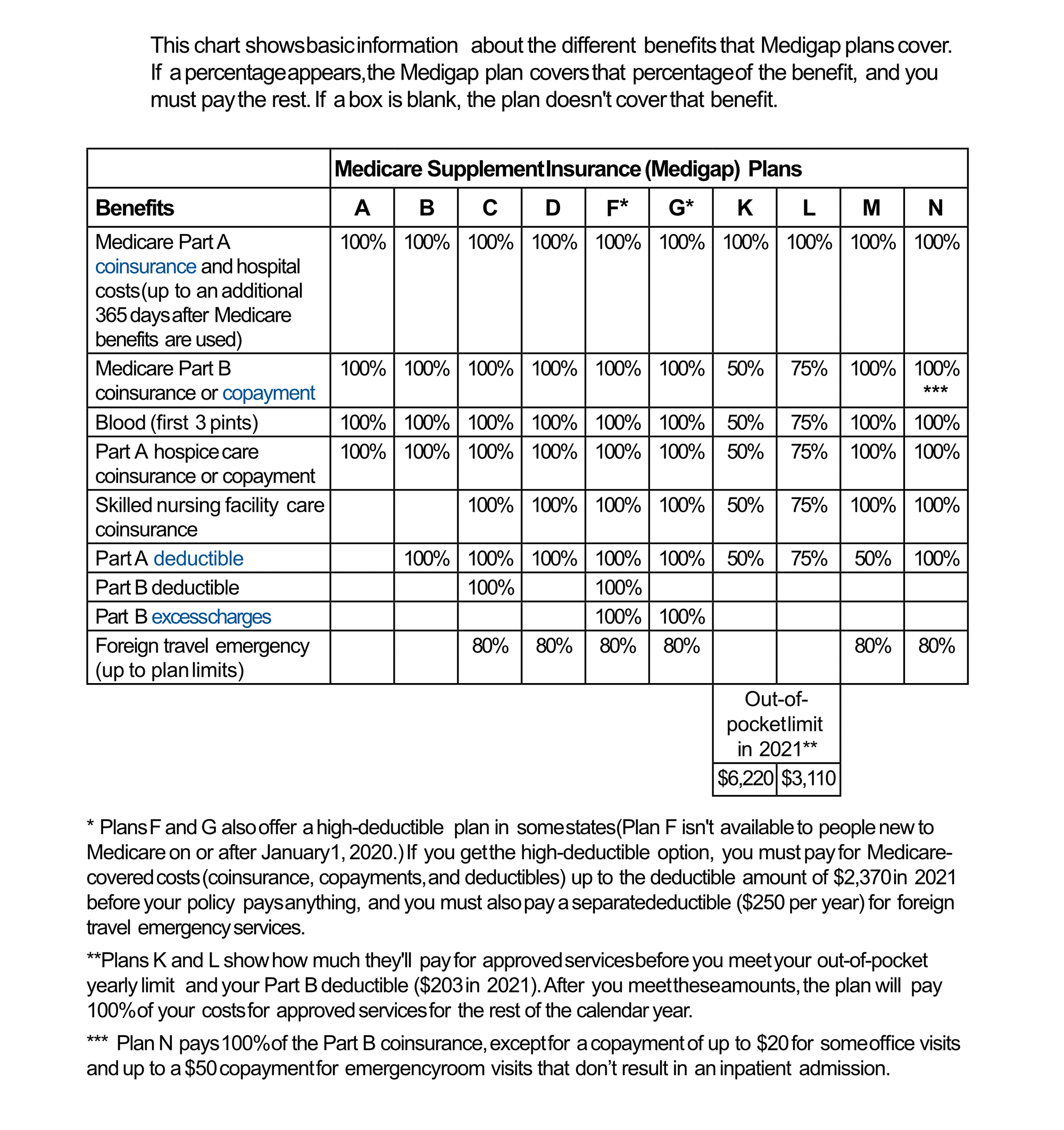

* Plans F and G also offer a high-deductible plan in some states (Plan F isn’t available to people new to Medicare on or after January 1, 2020.) If you get the high-deductible option, you must pay for Medicare covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,370 in 2021 before your policy pays anything, and you must also pay a separate deductible ($250 per year) for foreign travel emergency services.

**Plans K and L show how much they’ll pay for approved services before you meet your out-of-pocket yearly limit and your Part B deductible ($203 in 2021). After you meet these amounts, the plan will pay 100% of your costs for approved services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

This chart shows basic information about the different benefits that Medigap plans cover. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you must pay the rest. If a box is blank, the plan doesn’t cover that benefit.